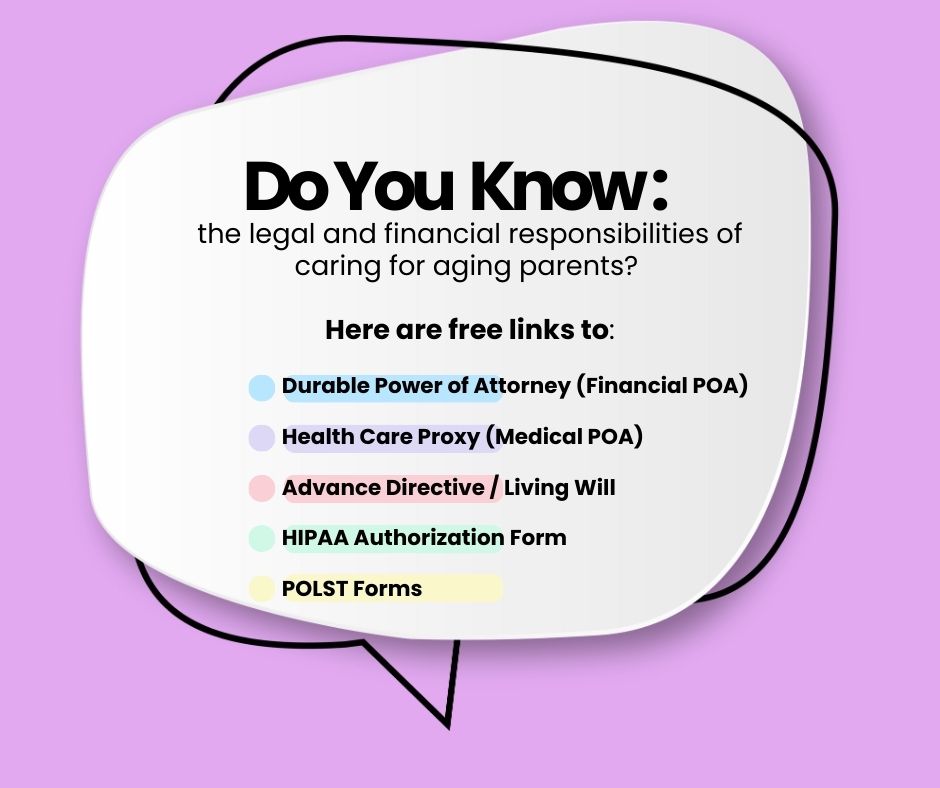

Legal and Financial Responsibilities when caring for Aging Parents

By Susan Chaityn Lebovits

As we embrace the beginning of fall, now is a great time to tackle the legal and financial responsibilities of overseeing care for our aging parents. Updating power-of-attorney documents, healthcare proxies, wills and checking on long-term care insurance policies sound like a big plate of stress with a side of overwhelm, but if you start now, you’ll be set before year’s end. Here is a detailed checklist with links to help proceed more efficiently.

Durable Power of Attorney (Financial POA)

This document allows a trusted person (often an adult child) to handle financial matters, such as managing bank accounts, paying bills, or filing taxes. Because it’s durable, it remains in effect even if the person becomes mentally incapacitated. If you want to avoid drowning in bills or missing important deadlines, a good POA is your life vest. Just a heads-up: a POA can be also used before incapacity, giving the appointed agent some control when needed.

Health Care Proxy (Medical POA)

This document authorizes someone to make medical decisions on the individual’s behalf when they are unable to do so themselves. It’s one of the most important tools in emergencies or end-of-life situations.

HIPAA Authorization Form

A HIPAA authorization form allows a named person (or people) to access private medical information — but does not allow them to make decisions for you. This authorizes release of health records to someone else (e.g., spouse, adult child). Can be limited to certain providers, conditions, or time periods. Useful even when one is not incapacitated — for example, if one wants an child to speak with their doctor about test results, allowing someone to see records or speak to doctors, but not make decisions.

POLST Form

The Physician Orders for Life Sustaining Treatment form (POLST) honors the wishes of those with serious illness or frailty—as is the case with many seniors. This includes telling all health care providers specific wishes during a medical emergency such as Do Not Resuscitate (DNR) but also make provisions for other types of treatment such as providing or not providing feeding tubes and mechanical ventilation.

Advance Directive / Living Will

This form outlines a person’s preferences for end-of-life care, such as whether they want to be kept on life support, receive artificial hydration, or other life-sustaining treatments. Find state-by- state forms in the link above.

Will and Estate Plan Updates

It’s not just about who gets what, but ensuring that your loved one’s wishes are crystal clear and legally bulletproof. If you’re able, contact a local estate attorney. If not, FreeWill (Sponsored by American Red Cross) allows one to create a legally valid Will online with step-by-step guidance. Print, sign, and witness it yourself. Note: No credit card is needed.

Long-Term Care Insurance and Benefits

If your parent has long-term care, make sure policies are current and understand what is covered and what is not.

Digital Medical History and Medication List

Caregivers should maintain an up-to-date list of diagnoses, medications, allergies, healthcare providers, and relevant medical events. This can be critical during emergencies or hospital visits. Some free portals include Acensa Health and One Record.

Create a go-to binder or digital folder

Include wills, insurance papers, financial statements, medical information and emergency contacts.

Great options include Dropbox, Google Drive, or Microsoft OneDrive, which can be accessed anywhere, or sent to anyone in case of an emergency.

Have questions? Please reach out to us at Info@EaseIntoAging.com